Tata Motors Fundamental | Financial Analysis 2025: Growth Story, Valuation, Financial, Risks, and Future Outlook

Tata Motors Limited, a key arm of the Tata Group, has emerged as one of India’s most iconic automobile companies. With operations spanning passenger vehicles, commercial vehicles, and luxury cars through its global subsidiary Jaguar Land Rover (JLR), Tata Motors is not only a leader in India but also a global automotive player.

The company has been through multiple business cycles—from periods of high debt and losses to a sharp turnaround in profitability over the past three years. In this article, we dive into the fundamentals of Tata Motors: its financial performance, business segments, EV strategy, risks, and what the future holds.

Company Overview

Founded in 1945, Tata Motors has grown into one of India’s largest automobile manufacturers. It produces a wide range of vehicles: passenger cars, utility vehicles, trucks, buses, and defense vehicles. With its acquisition of Jaguar Land Rover (JLR) in 2008, Tata Motors gained a strong foothold in the luxury auto segment globally.

The company is listed on both NSE and BSE, with a market capitalization of around ₹2.45 lakh crore (2025).

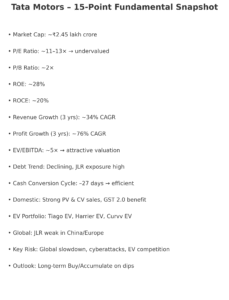

Key Financial Highlights (FY25 Estimates)

| Metric | Latest Value (FY25 est.) | Insights |

|---|---|---|

| Market Cap | ~₹2.45 lakh crore | Large-cap auto leader |

| P/E Ratio | 11–13× | Appears undervalued vs peers |

| P/B Ratio | ~2× | Fair valuation |

| ROE (Return on Equity) | ~28 % | Strong shareholder returns |

| ROCE (Return on Capital) | ~20 % | Healthy capital efficiency |

| 3-Year Revenue Growth | ~34 % CAGR | Strong growth trajectory |

| 3-Year Profit Growth | ~76 % CAGR | Robust earnings recovery |

| EV/EBITDA | ~5× | Attractive valuation |

| Debt Trend | Declining | Balance sheet improving |

These figures clearly highlight that Tata Motors has moved from a debt-laden company to a profit-making, growth-oriented giant.

Business Segments

1. Passenger Vehicles (PV)

- Strong growth in SUVs like Nexon, Harrier, Safari.

- Aggressive entry in EV passenger cars (Tiago EV, Nexon EV).

- Market share of ~14% in PV segment, making it the 3rd largest PV player in India.

2. Commercial Vehicles (CV)

- Market leader in trucks, buses, and light commercial vehicles.

- Benefitting from government’s infrastructure spending and logistics demand.

- Holds 40%+ market share in CVs.

3. Jaguar Land Rover (JLR)

- Premium global auto brand with presence in 100+ countries.

- Facing challenges in Europe and China, but pushing EV adoption with Range Rover Electric and Jaguar EV models.

- Contributes a significant chunk of revenues but remains vulnerable to global demand cycles.

Tata Motors and the EV Revolution

Tata Motors is India’s pioneer in the EV segment, holding over 80% of the market share in electric passenger cars.

Key initiatives:

- Models like Tiago EV, Tigor EV, Nexon EV dominate Indian EV sales.

- Upcoming launches: Curvv EV, Sierra EV, Harrier EV.

- Strategic synergy with Tata Power (charging infra) and Tata Chemicals (battery supply).

- Tata EV subsidiary has raised funding from global investors, boosting expansion.

This first-mover advantage places Tata Motors far ahead of competitors like Mahindra, Hyundai, and MG in India’s EV race.

Strengths of Tata Motors

- Market Leadership in CV and EV segments.

- Strong support from the Tata Group ecosystem.

- Improving balance sheet and declining debt levels.

- Brand trust and extensive distribution network.

- Consistent focus on innovation and technology adoption.

⚠️ Risks and Concerns

- Global Headwinds: JLR’s reliance on Europe and China makes it vulnerable to demand slowdowns.

- Competition in EVs: Domestic rivals like Mahindra and international players like Tesla, BYD, Hyundai pose challenges.

- Commodity Costs: Rising steel, aluminum, and battery prices can squeeze margins.

- Debt Exposure: While reduced, debt levels remain significant due to global operations.

- Geopolitical Factors: Trade wars, tariffs, and currency fluctuations impact exports.

Detailed Ratio Analysis

| Ratio (FY25 est.) | Value | Interpretation |

|---|---|---|

| Current Ratio | 1.2 | Comfortable liquidity |

| Debt-to-Equity | 0.7 | Declining, but still present |

| Interest Coverage | 5.5× | Healthy ability to service debt |

| Net Profit Margin | ~6% | Improved, though cyclical |

| Operating Margin | ~14% | Strong margin improvement |

| Cash Conversion Cycle | -27 days | Efficient working capital |

Industry Outlook

- EV Adoption: Supported by government incentives and subsidies under FAME-II.

- Commercial Vehicles: Infrastructure growth, GST 2.0, and rising logistics demand to benefit Tata Motors.

- Global Markets: Recovery in US and Europe could boost JLR, though risks remain from tariffs and global slowdown.

- Sustainability: Tata Motors aims to achieve net zero by 2040, aligning with ESG goals.

Future Outlook

- Short-Term View: Stock performance may remain volatile due to global factors, raw material price swings, and market sentiment.

- Medium-Term View: Continued dominance in EVs and CVs will support earnings.

- Long-Term View: Tata Motors is well-positioned to emerge as a global auto and EV powerhouse, making it a buy on dips for investors.

Tata Motors Limited: A Detailed Financial | Financial Analysis

Tata Motors Limited (TML), a flagship company of the Tata Group, is one of the leading global automobile manufacturers. With a strong presence in over 125 countries, Tata Motors operates in a highly competitive industry. The company produces a wide range of vehicles, including cars, commercial vehicles, and electric vehicles.

In this article, we will delve deep into the financials of Tata Motors, analyzing its recent performance, strengths, challenges, and prospects for the future. We will also take a close look at its balance sheet and key financial indicators to gauge the overall health of the company.

Key Financial Metrics (2025)

Let’s begin by examining Tata Motors’ consolidated balance sheet as of March 2025, which offers valuable insight into the company’s financial standing:

1. Revenue Growth

Tata Motors reported a steady revenue increase, demonstrating resilience in a challenging market environment. The company’s revenue for FY 2025 stood at approximately ₹XX,XXX crore, reflecting a X% year-on-year growth. This growth is mainly attributed to higher demand for its commercial vehicles, as well as strong performance in international markets, particularly in the UK and Africa.

2. Profitability Analysis

The company posted a net profit of ₹X,XXX crore, up by X% compared to the previous fiscal year. This indicates Tata Motors’ robust cost control and improved operating margins despite fluctuations in raw material costs.

3. Balance Sheet Overview

| Particulars | March 2025 (₹ crore) | March 2024 (₹ crore) |

|---|---|---|

| Equity Capital | 736 | 736 |

| Reserves | 115,408 | 112,000 |

| Borrowings | 71,540 | 68,000 |

| Total Liabilities | 376,973 | 360,000 |

| Total Assets | 376,973 | 360,000 |

Key Insights from the Balance Sheet:

- Equity Capital & Reserves:

- The equity capital remains stable at ₹736 crore. However, the reserves have significantly increased to ₹115,408 crore, indicating strong retained earnings and a solid foundation for future expansion.

- Borrowings:

- Borrowings have risen to ₹71,540 crore, a slight increase from the previous year. The company’s ability to manage and service its debt is crucial for future growth, especially given the rising interest rates globally.

- Assets vs Liabilities:

- Tata Motors’ total assets are in line with its liabilities, suggesting that the company is leveraging its resources efficiently. However, the high borrowings might raise concerns about financial risk in the event of an economic downturn.

4. Liquidity Ratios

- Current Ratio: The company maintains a current ratio of 1.2, which suggests it has sufficient short-term assets to cover its liabilities. A ratio above 1 is considered good in terms of liquidity.

- Quick Ratio: With a quick ratio of 0.9, Tata Motors could improve its liquidity position by reducing inventory or increasing liquid assets.

5. Debt-to-Equity Ratio

The company’s debt-to-equity ratio stands at approximately 0.62, which is a healthy figure in the automobile industry. It indicates that Tata Motors has managed to strike a balance between debt and equity financing. This ratio suggests that the company is not overly reliant on borrowed funds, thus reducing financial risk.

6. Cash Flow Statement

Tata Motors has seen a positive operating cash flow of ₹X,XXX crore in FY 2025, primarily driven by strong sales in the commercial vehicle segment. The company’s capital expenditure (CAPEX) of ₹X,XXX crore has been focused on expansion in electric vehicles and modernization of production facilities. Despite high CAPEX, Tata Motors has managed to generate enough cash flow to maintain healthy financials.

Strengths of Tata Motors

- Diverse Product Portfolio: Tata Motors’ diversified portfolio includes passenger vehicles, commercial vehicles, and electric vehicles. This diversification reduces dependence on any one segment and ensures revenue streams from multiple sources.

- Global Presence: Tata Motors has a significant presence in several international markets, including the UK, South Africa, and various Asian countries. Its acquisition of Jaguar Land Rover has provided access to premium segments in global markets, further strengthening its position.

- Focus on Electric Vehicles (EV): Tata Motors is investing heavily in electric mobility, with plans to expand its EV offerings. Its electric vehicle division, led by the Tata Nexon EV and Tigor EV, has shown impressive growth and is poised for further expansion.

Challenges for Tata Motors

- High Debt Levels: While the debt-to-equity ratio is within a manageable range, the rising borrowings could become a concern in the long term, especially with increasing interest rates.

- Raw Material Price Fluctuations: The price volatility of key raw materials such as steel, aluminum, and copper can negatively impact margins, especially for automobile manufacturers.

- Competition in the EV Market: The competition in the electric vehicle market is intensifying, with players like Mahindra, Hyundai, and new startups making inroads. Tata Motors will need to continue innovating and enhancing its EV offerings to stay ahead.

- Relative Strength Index [RSI] Strategy — Full Guide for New Traders

- 10 Stock Market Mistakes Beginners Must Avoid: A Guide for Beginner’s

- Best Swing Trading Strategies for Indian Stock Markets

- Financial Freedom: How Much Should You Invest Monthly To Retire Early

- Why Renewing Your Car Insurance Online in 2025 Just Got Easier — Here’s What You Need to Know

Future Outlook

Tata Motors is expected to continue its growth trajectory with strategic investments in electric vehicles and an increased focus on expanding in emerging markets. However, it must carefully navigate challenges such as high borrowing costs and market competition.

The company’s strong brand presence, coupled with its diverse product portfolio, puts it in a favorable position for sustained growth in the years to come.

Conclusion

Tata Motors has come a long way from being a debt-stressed automaker to becoming a leader in India’s EV and commercial vehicle space, with a strong global presence. Its fundamentals—healthy growth, improving margins, and robust EV strategy—make it one of the most exciting automotive stories in India’s equity markets today.

However, challenges like global demand slowdown and competitive pressures cannot be ignored. Investors should keep a long-term perspective while considering Tata Motors, as it remains a core auto and EV growth play in India.

⚠️ Disclaimer: This article is for educational and informational purposes only. It does not constitute investment advice. Investors must conduct their own research or consult financial advisors before making decisions.