Indian stock markets continued to remain under pressure in the mid-morning session on Friday, September 26, 2025, as both benchmark indices slipped notably due to widespread selling across key sectors. At 11 AM IST, the Sensex was down by more than 300 points, while the Nifty 50 traded near the 24,800 mark, reflecting weak investor sentiment.

Benchmark Indices Under Pressure

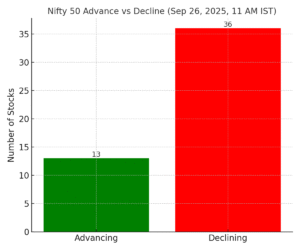

The Nifty 50 slipped around 0.4%, dragged by weakness in IT, pharma, and PSU banking counters. The Sensex also mirrored this trend, weighed down by selling in frontline stocks. Market breadth remained negative as declines outnumbered advances, signaling persistent bearish momentum.

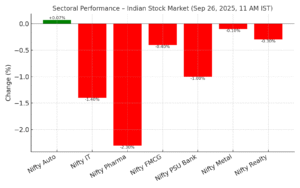

Sectoral Performance at a Glance

Barring the auto sector, which managed to hold in positive territory, all other major indices slipped into the red. IT and pharma stocks were the hardest hit, falling between 1% and 2%.

Here is a detailed look at the sectoral performance:

| Sector | Change (%) |

|---|---|

| Nifty Auto | +0.07 |

| Nifty IT | -1.4 |

| Nifty Pharma | -2.3 |

| Nifty FMCG | -0.4 |

| Nifty PSU Bank | -1.0 |

| Nifty Metal | -0.1 |

| Nifty Realty | -0.3 |

The BSE Midcap index slipped 0.6%, while the BSE Smallcap index was down 0.8%, showing that the selling pressure extended beyond large-cap stocks.

Top Gainers and Losers

- Top Losers: Infosys, HCL Technologies, Tech Mahindra, Asian Paints, Bajaj Finance

- Top Gainers: Larsen & Toubro, Hero MotoCorp, JSW Steel, Tata Steel, ONGC

The advance-decline ratio on the Nifty stood at 13 advancing versus 36 declining stocks, reinforcing the bearish undertone.

Policy and Global Impact

Pharmaceutical stocks came under sharp selling pressure after US President Donald Trump announced a 100% tariff on branded drugs exported to the US, dampening investor sentiment in the sector.

On the IPO front, activity was mixed. BMW Ventures IPO saw modest participation with a subscription of only 0.30 times so far, while Jain Resource Recycling IPO attracted stronger demand. Other stocks in focus included RITES, Ceigall India, Polycab, GRM Overseas, and Saatvik Green Energy.

Technical Outlook and Currency Update

Technically, the Nifty has immediate support at 24,800, and a breakdown below this level may trigger further downside toward the 24,600 zone. Resistance is placed near the 25,000 mark, which could cap any short-term rebound.

Meanwhile, the Indian rupee opened flat, trading at 88.68 per dollar, as traders stayed cautious amid global and domestic uncertainties.

Market Outlook

Overall, the Indian equity market remains under pressure with foreign institutional selling, weak global cues, and fresh tariff-related concerns weighing heavily. Investors are advised to stay cautious, as volatility is likely to persist in the near term.