“Mumbai as India’s millionaire capital with highest number of wealthy households in 2025”

India’s Rising Wealth: A Snapshot from the Hurun Report

India is witnessing an unprecedented surge in prosperity. The Mercedes-Benz Hurun India Wealth Report 2025 reveals how the country’s economic landscape is transforming, with more people entering high-income and millionaire brackets every year.

Growth in High-Income Earners

Over the past six years, India has seen a dramatic increase in individuals declaring large annual incomes.

- In Assessment Year (AY) 2017–18, about 81,000 people filed ITRs with incomes above ₹1 crore.

- By AY 2023–24, this figure nearly tripled to 2.27 lakh.

This growth is fueled by strong economic development, entrepreneurship, and booming stock markets, enabling more Indians to generate and grow wealth.

The Wealth Pyramid Narrows at the Top

While the millionaire population is expanding, very few reach the ultra-rich category.

- Just 0.07% of millionaires achieve a net worth of ₹1,000 crore.

- Only 0.01% become billionaires.

This shows that while prosperity is becoming more widespread, extreme wealth remains limited to a select few.

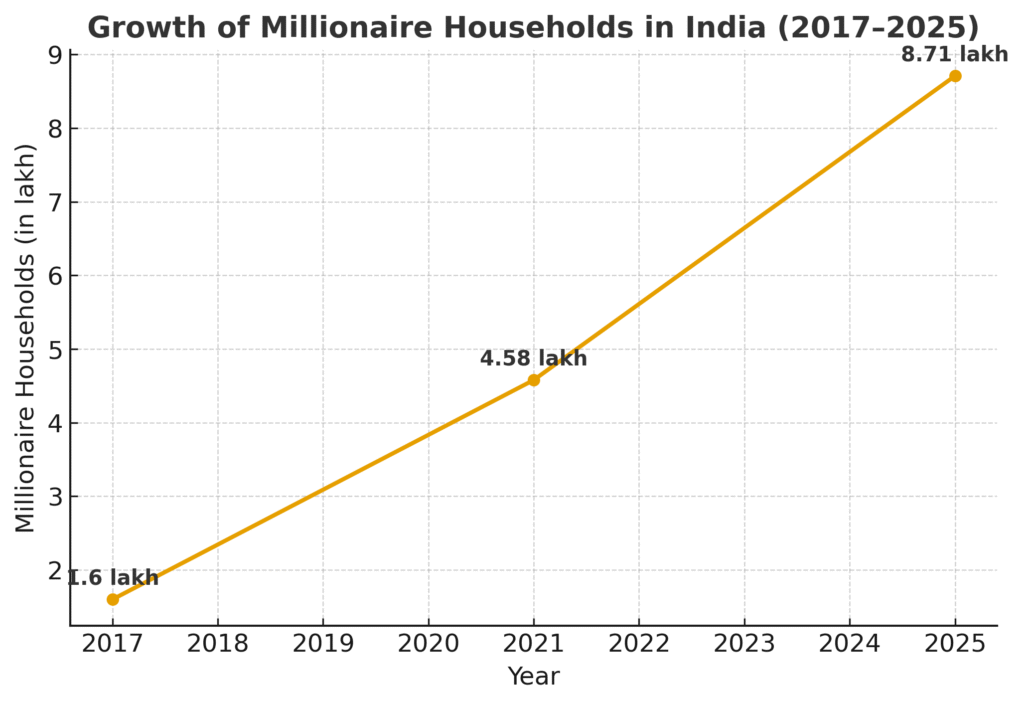

Millionaire Households: A Sharp Increase

By 2025, India is projected to have 8.71 lakh millionaire households (net worth above ₹8.5 crore).

Comparison:

- 2021: 4.58 lakh families

- 2017: 1.6 lakh families

That’s a 90% increase in four years, with millionaire households now forming 0.31% of India’s population.

Wealth Concentration by State

- Maharashtra leads, with Mumbai hosting 1.42 lakh millionaire households, making it India’s Millionaire Capital.

- The top ten states—including Maharashtra, Delhi, Tamil Nadu, Karnataka, and Gujarat—account for 79% of all millionaire families.

Wealth Spreads to Tier II Cities

Beyond metros, smaller hubs like Ahmedabad, Surat, and Jaipur are also seeing significant growth in millionaire families. Increasing use of wealth management and investment services shows that affluence is spreading beyond big cities.

Still, moving from millionaire to ultra-high-net-worth (₹100 crore+) remains rare, and billionaire status is achieved by only a handful.

Impact on Taxation and Society

The rise in high-income earners is broadening India’s tax base, giving the government more resources. However, the concentration of extreme wealth highlights the challenge of inequality.

Policymakers must ensure that growth remains inclusive, balancing tax frameworks, wealth distribution, and long-term prosperity.

India at a Crossroads

India’s wealth story is impressive, driven by innovation, entrepreneurship, and capital markets. Yet, while millionaire families are booming, the ultra-rich category remains an exclusive club.

The coming years will define how India balances rapid wealth creation with fairness, ensuring a sustainable and inclusive future.