The festive season in India is always a period of heightened consumer activity, optimism, and stock market movement. As we approach the end of 2025, certain sectors are showing strong potential due to consumption trends, corporate earnings, and macroeconomic tailwinds. Whether you are a seasoned investor or a beginner, keeping an eye on these sectors can help you make informed investment decisions.

Here are the top 5 sectors to watch this festive season:

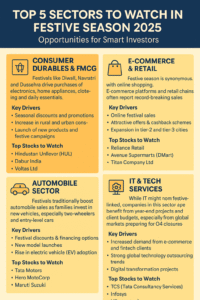

1️⃣ Consumer Durables & FMCG

Why it matters:

Festivals like Diwali, Navratri, and Dussehra drive a surge in purchases of electronics, home appliances, clothing, and daily essentials. Companies in the FMCG (Fast-Moving Consumer Goods) space often witness higher sales during this period.

Key Drivers:

- Seasonal discounts and promotions

- Increase in rural and urban consumption

- Launch of new products and festive campaigns

Top Stocks to Watch:

- Hindustan Unilever (HUL) – Strong distribution network

- Dabur India – Herbal and health products in demand

- Voltas Ltd – Home appliances surge in sales

2️⃣ E-Commerce & Retail

Why it matters:

The festive season is synonymous with online shopping. E-commerce platforms and retail chains often report record-breaking sales, fueled by digital penetration and growing consumer confidence.

Key Drivers:

- Online festival sales

- Attractive offers and cashback schemes

- Expansion in tier-2 and tier-3 cities

Top Stocks to Watch:

- Reliance Retail – Aggressive expansion and brand partnerships

- Avenue Supermarts (DMart) – Consistent performance with retail growth

- Titan Company Ltd – Jewelry and watches see festive surge

3️⃣ Automobile Sector

Why it matters:

Festivals traditionally boost automobile sales as families invest in new vehicles, especially two-wheelers and entry-level cars. This sector sees quarterly spikes in revenue and market share expansion.

Key Drivers:

- Festival discounts and financing options

- New model launches

- Rise in electric vehicle (EV) adoption

Top Stocks to Watch:

- Tata Motors – Strong EV push and commercial vehicle sales

- Hero MotoCorp – Two-wheeler demand remains robust

- Maruti Suzuki – Popular for festive season purchases

4️⃣ Banking & Financial Services

Why it matters:

Increased spending during festivals leads to higher demand for loans, credit cards, and insurance. This boosts the revenue of banks and financial services companies.

Key Drivers:

- Short-term personal and vehicle loans

- Higher credit card usage

- Investment in mutual funds and insurance policies

Top Stocks to Watch:

- State Bank of India (SBI) – Leading bank with wide outreach

- HDFC Bank – Retail lending growth

- ICICI Bank – Strong digital banking presence

5️⃣ IT & Tech Services

Why it matters:

While IT might not seem festive-linked, companies in this sector often benefit from year-end projects and client budgets, especially from global markets preparing for Q4 closures.

Key Drivers:

- Increased demand from e-commerce and fintech clients

- Strong global technology outsourcing trends

- Digital transformation projects

Top Stocks to Watch:

- TCS (Tata Consultancy Services) – Global IT demand

- Infosys – Strong client addition

- HCL Technologies – Diverse IT services portfolio

Suggested Table for Quick Reference:

| Sector | Key Drivers | Top Stocks | Potential Opportunity |

|---|---|---|---|

| Consumer Durables & FMCG | Seasonal purchases, promotions | HUL, Dabur, Voltas | High demand during festivals |

| E-Commerce & Retail | Online sales, discounts | Reliance Retail, DMart, Titan | Growing urban and digital penetration |

| Automobile | Vehicle purchases, new launches | Tata Motors, Hero MotoCorp, Maruti Suzuki | Surge in 2W & EV sales |

| Banking & Financial Services | Loans, credit, insurance | SBI, HDFC Bank, ICICI Bank | Increased retail spending |

| IT & Tech Services | Year-end global projects | TCS, Infosys, HCL Tech | Strong Q4 client demand |

Conclusion

The festive season of 2025 presents a unique opportunity for investors to capitalize on sectoral growth trends. From FMCG and retail to automobiles and IT services, careful selection of stocks based on market data, historical performance, and future potential can lead to profitable investments.

Remember, festive season trends are short-term catalysts, so pair them with long-term investment strategies for better portfolio growth.

FAQ

What are the key sectors to watch during the festive season of 2025 in India?

The key sectors to watch during the festive season of 2025 in India include Consumer Durables & FMCG, E-Commerce & Retail, Automobile, Banking & Financial Services, and IT & Tech Services.

Why is the Consumer Durables & FMCG sector significant during festivals?

The Consumer Durables & FMCG sector is significant during festivals because festive occasions like Diwali, Navratri, and Dussehra lead to increased purchases of electronics, home appliances, clothing, and essentials, driven by seasonal discounts, promotions, and new product launches.

How does the E-Commerce & Retail sector benefit during the festive season?

The E-Commerce & Retail sector benefits during the festive season due to a surge in online shopping, attractive offers, cashback schemes, and expansion into tier-2 and tier-3 cities, resulting in record-breaking sales across platforms.

What motivates automobile sales during festivals in India?

Automobile sales are motivated during festivals by seasonal discounts, attractive financing options, new model launches, and the rising adoption of electric vehicles, leading to a boost in family vehicle purchases.

How do banking and financial services perform during festivals, and which stocks are worth watching?

During festivals, banking and financial services see increased demand for loans, credit cards, and insurance, bolstered by higher spending. Key stocks to watch include SBI, HDFC Bank, and ICICI Bank.